Stability, guarantees, durability, without investing time and effort - all this perfectly characterizes passive income from renting out an apartment for rent. But what is this income? How much will you receive and how quickly will the square meters pay off? Is it really profitable to buy rental property? We could say that if you don't try, you won't know. But THE Capital does not make groundless promises and does not throw around words in vain, so instead of empty assurances of a happy future, we suggest you strain a little and calculate the real profitability of the apartment. There is no need to take a calculator because everything has already been calculated for you.

Step-by-step instructions for calculating profit

We would like to warn you right away that calculations can only approximately reflect reality. This is not because our math skills are lacking, but because of larger factors. No matter how far into the future you try to look, you can only do so based on the current situation. Life does not take into account your desire for stability and can sometimes turn in a completely unpredictable direction. Speaking about the real estate market, it is worth understanding that it is influenced by many factors, among which there are political and economic situations, seasonality, fluctuations in supply and demand, and now war with its consequences. May change over the years market price real estate taxes and the costs of its maintenance. It will not be possible to predict the fate of your apartment down to the hryvnia in its rental price. Therefore, calculating profitability gives only an approximate understanding of how profitable the acquisition of square meters will be. So, to determine profitability you will need:

- indicate the rental income you receive per year. This is easy to do - multiply the monthly fee by 12;

- understand what your costs will be and how much they will cost. Feel free to enter in the expenses column taxes for real estate and agency services. Additional expenses may include repair work (they can be carried out at will or as needed, so it is not a fact that they will be required at all) and insurance (again, everything depends only on your desire). In some situations, it is necessary to take into account the payment of utility bills, but in most cases it falls on the shoulders of the tenants;

- calculate net rental income. Subtract the costs associated with maintaining real estate from your annual income;

- determine the profitability of renting out an apartment or house. Finally we have reached the final point. It is necessary to divide the net rental income by the cost of the property. Profitability is determined as a percentage, so the resulting number must be multiplied by 100.

*all calculations were carried out without taking into account the potential period of time it would take to find tenants

An example of calculating profitability from real estate rental

Let's imagine that you are already with our help bought an apartment в Pechersky district. It is considered one of the most prestigious in the capital, so the prices here are appropriate. Your one-room beauty cost $185,000. Of course, we are talking about a property in a top residential complex and with designer renovation. Can you afford to rent out a property like this for $1,200 like this already doing our clients. Let's say that in one year you spend $600 on some minor improvements to your property. Now we know all the basic amounts and we can start calculating:

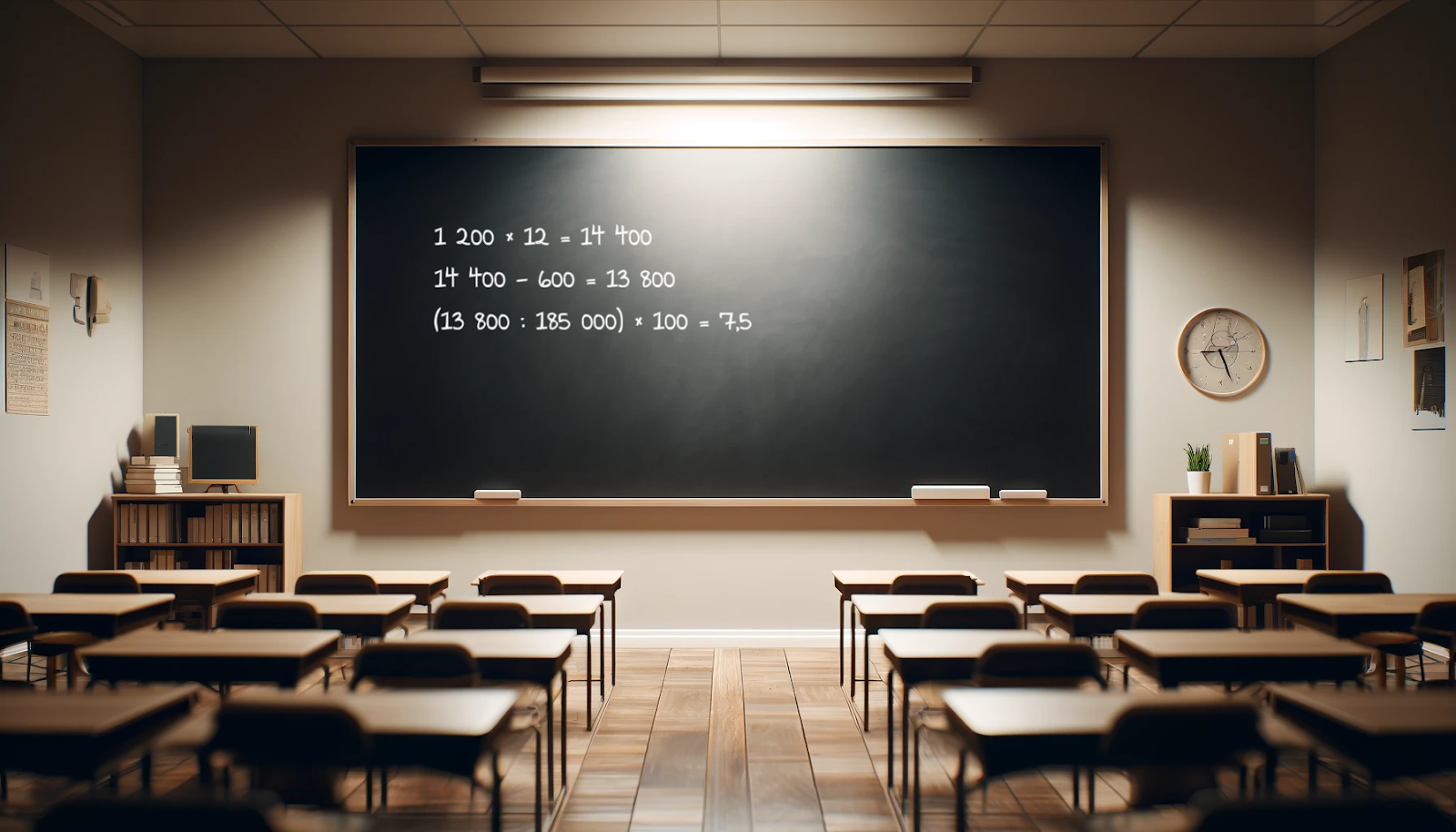

- annual rental income – $1,200 × 12 = $14,400;

- expenses – $600;

- net profit from surrender – $14,400 - $600 = $13,800;

- rental yield – ($13,800 / $185,000) × 100% = 7,5%

The result shows that in a year, with the help of rent, you can return 7,5% of the amount you invested in the purchase housing. Your investment will fully pay off after 13 years, which is a pretty good indicator.

Among the risks and additional expenses that may affect the final result are the dishonesty of tenants and taxation on income from renting out real estate. There are situations when the tenant refuses to pay, but our agency is not aware of such cases. Before signing, we always check the reliability of the parties, so this risk can be safely crossed out. As for taxes, the legislation of Ukraine states that the landlord is obliged to pay an amount of 18% of income and an additional 1,5% military tax.

It seems that 7,5% had an inspiring effect on you. We suggest that you do not waste time and immediately familiarize yourself with range of apartmentsavailable for purchase. Contact our experts to get advice and choose the most profitable option.